Quick answer: The Best Coinbase Alternative in 2025 is Pionex!

Coinbase is one of the most used and popular cryptocurrency trading platforms. It is packed with various features which allow crypto enthusiasts to trade their digital assets and even invest and hold crypto.

It has a large user base which makes it an ideal platform to trade and invest. Additionally, it hosts a lot of digital products in its offer.

However, just like every online platform Coinbase isn’t perfect, it has numerous drawbacks which make it not everyone’s first choice when it comes to crypto exchange platforms and portfolio trackers.

Luckily, many other platforms offer similar features, as well as some additional features too.

If you’re looking to discover new Coinbase alternatives that will be aligned with your investment business vision and investment plans continue reading this article where we detailed the 10 best Coinbase alternatives for your crypto savings.

Primarily, given that Coinbase fees are some of the most problematic things for new crypto investors, many are looking for alternatives that will allow them to save up on transactions.

The apps we’ll present you with will enable you to invest in stocks and crypto, automate the orders, buy crypto, and much more. Continue reading.

1. 10 Best Coinbase Alternatives in June 2025

If you’re among people who think Coinbase just isn’t the right platform for them, check these 10 Coinbase alternatives and find the option that suits you the most.

1.1 Pionex

Pionex presents itself as a compelling alternative to Coinbase, particularly for users looking for advanced trading tools, automation, and lower fees. Here’s a detailed explanation of its advantages:

Key Features:

-

Leveraged Grid Bot: This tool offers up to 5 times leverage, enhancing trading capabilities and potentially increasing profits for experienced traders.

-

Automated Grid Bot: It automates the buying and selling process, allowing users to capitalize on market fluctuations by selling high and buying low without manual intervention.

-

Dollar-Cost Averaging (DCA): This feature automates the process of placing a series of buy orders, which can be a strategic approach to investing in volatile markets like cryptocurrencies.

-

Portfolio Rebalancing Bot: Useful for recovering from trading setbacks, this bot helps in maintaining a balanced portfolio according to the user’s predefined criteria.

-

TradingView Integration: Offers comprehensive charts and tools from TradingView, assisting users in making informed trading decisions based on market trends and portfolio performance.

Pros:

-

Variety of Bots: With 16 to 18 different bots, Pionex caters to various trading strategies and needs, making it suitable for both novice and experienced traders.

-

User-Friendly Interface: The platform offers a clean and intuitive interface, making navigation and trading straightforward, even for beginners.

-

Low Fees: Charging only $0.05 per transaction, Pionex is an economical choice, especially for those engaging in high-volume trading.

-

Efficient Customer Support: Quick and responsive support enhances the user experience, particularly important in the fast-paced crypto market.

Cons:

- Limited Currency Options: While Pionex supports a wide range of cryptocurrencies, it lacks options for fiat currencies, which might be a drawback for users looking to trade directly with traditional currencies.

Ideal for:

- Passive Investors: The automated tools and bots make it a suitable platform for those who prefer a more hands-off approach to crypto investing.

- Active Traders: The low fees and automated trading bots cater well to users who engage in high-volume or frequent trading.

- Beginners: Its intuitive interface and straightforward process make it accessible for those new to cryptocurrency trading.

Conclusion:

Pionex stands out as a viable Coinbase alternative, especially for users interested in leveraging advanced trading bots, enjoying low transaction fees, and engaging in both passive and active crypto trading. Its blend of automation, user-friendliness, and cost-effectiveness makes it an attractive platform, although the limited fiat currency options might require users to use additional services for certain types of transactions.

1.2 Bitstamp

Bitstamp presents itself as a compelling alternative to Coinbase for various reasons, catering to both beginners in the cryptocurrency space and more experienced traders or institutional clients. Here’s an overview of why Bitstamp stands out:

Key Features of Bitstamp

-

Competitive Fee Structure:

- Bitstamp offers a fee of $0.50 for trading volumes less than $10,000, which is competitive in the market.

- Notably, the fees decrease with higher trading volumes, benefiting active traders with larger transaction volumes.

-

User-Friendly Interface:

- The platform is designed with a clean and intuitive interface, making it accessible and easy to navigate for beginners.

-

Learning Resources:

- Bitstamp provides an advanced learning center, featuring educational articles and video tutorials, which is especially beneficial for new crypto traders seeking to enhance their knowledge.

-

Security Measures:

- Personal data on Bitstamp is protected with robust encryption algorithms.

- The platform employs a security system that safeguards funds both offline and during active trading.

- A significant portion of assets are stored offline, offering an additional layer of security against online threats.

- Bitstamp also includes features like transaction whitelisting and thorough confirmation processes for added safety.

-

Support for Institutional Trading:

- While it caters to beginners, Bitstamp also supports institutional trading, indicating a range of features and capabilities that can satisfy more advanced trading requirements.

-

Instant Deposit Options:

- The platform offers instant deposit options, enhancing the convenience and efficiency of transactions.

Pros

-

Competitive Uptime:

- Bitstamp is known for its reliable platform uptime, ensuring consistent access for users.

-

Responsive Customer Support:

- The platform provides quick and effective customer support, available 24/7, which is crucial for timely assistance and resolving any issues.

-

Beginner-Friendly Experience:

- Its clean interface and robust learning center make it an attractive option for beginners in the crypto market.

Cons

-

Limited Cryptocurrency Options:

- Compared to Coinbase, Bitstamp offers fewer cryptocurrencies, which might be a drawback for users looking for a wide range of crypto options.

-

Higher Initial Fees:

- The fee structure, while competitive, can be relatively high for smaller trading volumes, which might be a consideration for casual traders or those starting with smaller amounts.

Conclusion

Bitstamp emerges as a strong Coinbase alternative, particularly for beginners and passive crypto traders, thanks to its user-friendly interface, competitive fee structure, robust security measures, and comprehensive learning resources. While it may have fewer cryptocurrency options and higher initial fees compared to some competitors, its features make it a viable choice for a broad spectrum of users, from novice traders to institutional clients.

1.3 Crypto.com

Crypto.com is gaining popularity as a viable alternative to Coinbase for various reasons, particularly for crypto merchants and those looking for a more feature-rich platform. Here’s a breakdown of why Crypto.com could be an appealing choice:

1. Lower Transaction Fees: Crypto.com offers competitive fees, ranging from 0.04% to 0.4% for maker fees and 0.1% to 0.4% for taker fees. This fee structure can be particularly attractive for active traders and merchants who engage in frequent transactions, as lower fees can significantly impact overall profitability.

2. Ideal for Merchants: The platform is tailored for individuals or entities selling products and services and wishing to accept payment in cryptocurrency. Its user-friendly interface and quick payout system make it an attractive option for merchants looking to integrate crypto payments into their business.

3. Supports a Wide Range of Currencies: With support for over 91 currencies, Crypto.com offers a broader selection compared to Coinbase. This diversity allows users to trade and transact in a wider variety of cryptocurrencies, which can be beneficial for users looking to explore beyond the more commonly traded coins.

4. Advanced Trading Features: The platform offers advanced features such as detailed crypto charts, up to 5x leverage, and a trading arena with prizes and rewards. These features can be particularly appealing to experienced traders looking for a more sophisticated trading environment.

5. Token Purchase Offers: Crypto.com occasionally offers the ability to purchase new tokens at a discounted rate (up to 50% off). This can be a significant advantage for traders looking to invest in emerging cryptocurrencies at a lower entry cost.

6. Strong Community and Support: The platform has a strong community presence and offers robust customer support, which can enhance the overall user experience, especially for those new to cryptocurrency trading.

Cons:

-

Learning Curve: The platform can be complex, especially for beginners or those not familiar with advanced trading features. This might make it less accessible compared to more user-friendly platforms like Coinbase.

-

Not Ideal for Low-Volume Traders: The platform’s fee structure and features are more suited for active, high-volume traders. Low-volume traders might not find the same level of benefit.

-

Fluctuations in Rewards: The rewards, particularly those paid out in CRO (Crypto.com’s native token), can be subject to market fluctuations, adding an element of variability to the rewards system.

-

Leverage Risks: While offering up to 5x leverage can be an advantage for experienced traders, it also introduces higher risks, especially for those who are not accustomed to trading with leverage.

In summary, Crypto.com presents itself as a solid Coinbase alternative, especially for crypto merchants and traders seeking a platform with lower fees, a wide range of supported currencies, and advanced trading options. However, its complexity and focus on high-volume trading might not suit everyone, especially those new to cryptocurrency trading or with lower trading volumes.

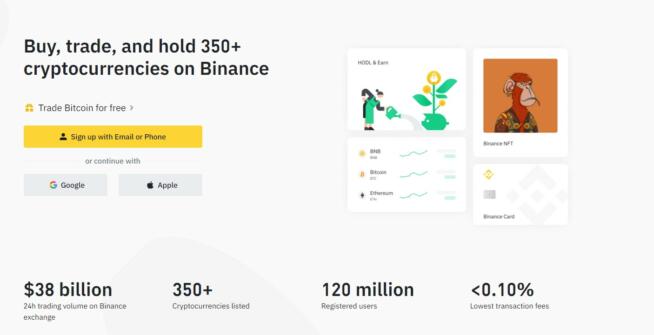

1.4 Binance

Binance serves as a strong alternative to Coinbase for various reasons, especially for users looking for a more diverse and feature-rich cryptocurrency trading experience:

-

Competitive Fees: Binance’s trading fees range from 0.02% to 0.1%, which is generally lower compared to many other platforms, including Coinbase. This fee structure can be particularly advantageous for active traders who engage in frequent transactions.

-

High User Activity and Popularity: As one of the most used crypto platforms globally, Binance boasts a large user base. This high level of activity often translates to better liquidity and potentially more trading opportunities, which is beneficial for both novice and experienced traders.

-

Wide Range of Cryptocurrencies: Binance supports a vast array of digital tokens, offering more trading pairs than Coinbase. This diversity allows users to trade in a wide variety of cryptocurrencies, providing more opportunities for diversification and investment.

-

Innovative Features and Products:

- Binance Chain and BNB Token: Binance offers its blockchain, the Binance Chain, and a dedicated platform token, BNB. These elements offer unique opportunities for trading and investment not available on Coinbase.

- NFT Trading: Binance is ideal for trading Non-Fungible Tokens (NFTs), a rapidly growing sector of the crypto market.

- Binance Smart Mining Pool: This feature allows users to engage in both mining and staking, offering more ways to earn crypto.

- Binance Visa Card: A convenient option for users who want to withdraw or spend their crypto holdings directly from the platform.

-

Mobile Apps: Binance provides dedicated iOS and Android apps, making trading accessible and convenient on mobile devices.

-

Ability to Build and Sell Products: On Binance, users have the opportunity to build their products on the Binance Chain, a feature not available on Coinbase. This opens up avenues for innovation and entrepreneurship in the crypto space.

However, there are some downsides to consider:

- Customer Support: Binance has faced criticism for poor customer support, which could be a drawback for users who require assistance.

- Learning Curve: The platform’s wide range of features and complex interface might be overwhelming for beginners, and Binance is often noted for its lack of educational content compared to Coinbase.

In conclusion, Binance is a compelling Coinbase alternative for users who are looking for lower fees, a wide range of cryptocurrencies, innovative trading features, and the flexibility to engage in activities like NFT trading and crypto mining. However, it might be more suitable for users who are comfortable navigating a more complex platform.

1.5 Robinhood

Robinhood is often considered a good alternative to Coinbase for several reasons, especially for those new to cryptocurrency trading. Here’s a breakdown of why it might be a suitable choice:

-

Fee Structure: One of Robinhood’s most appealing features is its fee structure for cryptocurrency trading. It offers free trading for cryptocurrencies, which is a significant advantage over many other platforms that charge fees for similar transactions. However, it’s important to note that there is a $5 fee for margin trading up to $1000.

-

Beginner-Friendly Interface: Robinhood is known for its clean, user-friendly interface, making it an excellent option for beginners in the crypto trading world. This ease of use can be a significant advantage for those who are new to trading and prefer a straightforward, intuitive platform.

-

No Commission on Trades: Robinhood does not charge commissions on cryptocurrency trades, which is a substantial benefit for traders looking to maximize their investments without worrying about additional costs.

-

Wide Range of Supported Cryptocurrencies: The platform supports a vast array of cryptocurrencies, including popular ones like Bitcoin, Bitcoin Cash, Dogecoin, Litecoin, Ethereum, and Ethereum Classic. This variety allows users to diversify their crypto portfolios easily.

-

No Minimum Account Balance: Robinhood doesn’t require a minimum balance to maintain an account, making it accessible for traders who might not have large amounts of capital to invest.

-

Immediate Bank Deposits: The ability to immediately deposit funds into a bank account is a convenient feature, offering flexibility and efficiency in managing finances.

-

Mobile App Support: Robinhood offers support for iOS and Android apps, allowing users to trade and manage their accounts conveniently from their smartphones.

Pros:

- Support for Many Cryptocurrencies: The platform’s support for a wide range of cryptocurrencies is a significant advantage for users looking to trade multiple types of digital currencies.

- Zero Commission Fees: This makes it more cost-effective for users, especially those who trade frequently.

- Clean and Beginner-Friendly User Interface: This aspect makes it easier for new traders to navigate and use the platform effectively.

- No Account Minimum: Allows users to start trading with any amount, making it accessible for a broader range of investors.

Cons:

- Poor Customer Support: This can be a drawback for users who might need assistance or encounter issues while using the platform.

- No Mutual Funds: Users looking for a broader range of investment options, including mutual funds, might find Robinhood limited in this regard.

In summary, Robinhood is a strong choice for those new to cryptocurrency trading, offering a beginner-friendly platform with no commission fees, a variety of supported cryptocurrencies, and convenient features like immediate bank deposits and mobile app support. However, its limitations in customer support and lack of mutual fund offerings are factors to consider.

1.6 Gemini

1.7 Kraken

Kraken emerges as a strong alternative to Coinbase for several reasons, particularly for users looking for a platform with a wide range of cryptocurrencies and strong security features. Here’s a detailed look at why Kraken stands out:

-

Low Fees: Kraken’s fee structure is competitive, ranging from 0% to 0.26% depending on the type and volume of transactions. This can be particularly appealing for high-volume traders who are looking to minimize costs.

-

Established and Secure: As one of the oldest cryptocurrency trading platforms, Kraken has built a reputation for security. The absence of major data leaks or hacking incidents enhances its credibility as a safe platform for crypto transactions.

-

Support for Numerous Cryptocurrencies: With support for over 180 cryptocurrencies, Kraken provides users with a wide range of trading options. This diversity is beneficial for those looking to trade in less common cryptocurrencies that might not be available on other platforms.

-

Versatility for Different Types of Traders: Kraken caters to both casual and institutional traders. Its features like trading, staking, and coin lending make it versatile for different trading strategies and investment approaches.

-

Advanced Trading Options: The platform offers advanced features such as margined futures trading, which is particularly useful for institutional investors. Regular traders can also benefit from rewards offered for frequent trading.

-

High Security Standards: Over 90% of deposits on Kraken are held in cold storage, indicating a strong emphasis on security. Cold storage refers to keeping assets offline, which greatly reduces the risk of hacking.

-

Robust Security Protocols: Kraken uses powerful hashing and encryption algorithms to protect user data and transactions, further enhancing its security credentials.

-

Comprehensive Learning Resources: The platform boasts a rich learning center, making it suitable for beginners who are new to cryptocurrency trading.

-

User-Friendly Interface: Kraken is known for its clean and organized user interface, which makes navigation and trading on the platform straightforward and user-friendly.

However, there are some cons to consider:

-

No Credit or Debit Card Support: Unlike some other platforms, Kraken does not support deposits via credit or debit cards, which may be inconvenient for some users.

-

Limited Availability: Kraken is not available in all U.S. states, which could be a significant limitation for users in those regions.

In summary, Kraken’s low fees, strong security measures, support for a vast array of cryptocurrencies, and user-friendly interface make it a compelling Coinbase alternative. However, its limitations, such as the lack of credit or debit card support and limited availability in the U.S., are important factors to consider when choosing a cryptocurrency trading platform.

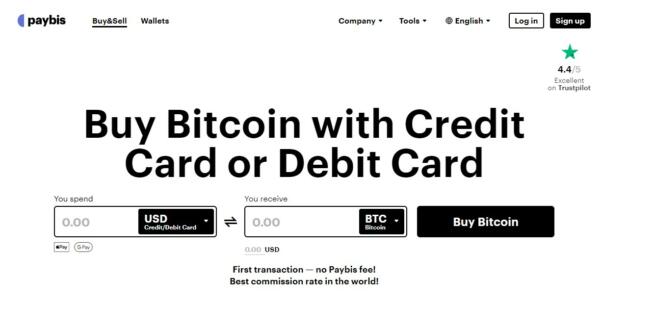

1.8 Paybis

Paybis offers several features that position it as a solid alternative to Coinbase, especially for those seeking a platform with a straightforward fee structure and wide global accessibility. Here’s a breakdown of why Paybis stands out:

Key Features:

-

Fixed Fees and Low Commissions: Paybis has a clear, fixed fee structure ($0.21 per transaction), making it easy for users to understand the costs associated with their trades. This transparency is beneficial, especially for beginners in the crypto market.

-

First Transaction Fee Waiver: The absence of fees on the first trading transaction can be an attractive incentive for new users, allowing them to experience the platform without initial costs.

-

Credit/Debit Card Support: The ability to buy cryptocurrencies using credit or debit cards adds convenience and accessibility, making it easier for both active investors and passive users to engage in crypto transactions.

-

Global Reach: Paybis supports transactions in over 180 countries, offering a broad reach that exceeds many other platforms. This widespread availability makes it an accessible option for a global audience.

-

Security Standards: High industry-standard security measures to prevent hacking and data leakage are crucial, given the sensitivity of crypto transactions.

-

Instant Payouts and Deposits: The platform ensures quick transaction processing, which is critical in the fast-paced crypto market.

-

Efficient Security Checks: Swift yet reliable security checks balance the need for security with user convenience.

-

User-Friendly Interface: An intuitive and clean interface enhances the user experience, especially important for those new to cryptocurrency trading.

Pros:

-

Ease of Navigation: The platform’s straightforward design makes it user-friendly, a significant advantage for newcomers to crypto trading.

-

Wide Availability: Being accessible in almost every part of the world makes it a viable option for a diverse user base.

-

Quick Security Protocols: Efficient security checks streamline the trading process without compromising safety.

-

Instant Financial Transactions: The ability to have instant payouts is a key feature for those who value quick access to their funds.

Cons:

-

Fee Perception: Some users might find the fees higher compared to other platforms, especially for smaller transactions.

-

Lack of Android Mobile App: The absence of a dedicated mobile app for Android users can be a limitation, as mobile trading is increasingly popular.

Ideal for:

- Beginners in Crypto Trading: The fixed fee structure, user-friendly interface, and security features make it a good starting point for those new to cryptocurrencies.

- Users Preferring Card Payments: For those who prefer using credit/debit cards for transactions, Paybis offers a convenient solution.

- Global Users: Its availability in over 180 countries makes it a suitable choice for international users.

Conclusion:

Paybis presents a compelling choice as a Coinbase alternative, especially for users looking for a platform with fixed fees, global reach, and a user-friendly experience. While the fee structure and lack of a comprehensive mobile app might be drawbacks for some, its accessibility and security features make it an attractive option for a broad range of crypto enthusiasts.

1.9 Uphold

1.10 ZenGo

ZenGo is emerging as an appealing Coinbase alternative for users who prioritize security and ease of use in their crypto trading platform. Let’s explore why ZenGo might be a suitable choice:

1. Advanced Security with No Private Key Vulnerability: One of ZenGo’s standout features is its approach to security, particularly its claim of eliminating private key vulnerabilities. This is achieved through the use of advanced cryptographic methods, offering a unique security model that doesn’t rely on a traditional private key setup. For users concerned about the security risks associated with managing private keys, ZenGo offers a more secure and less complex alternative.

2. Self-Custodial Wallet: As a self-custodial wallet, ZenGo gives users full control over their cryptocurrencies. This means that users have direct ownership and responsibility for their crypto assets, which is a significant advantage for those who prefer not to rely on third-party custodians.

3. Support for a Wide Range of Assets: ZenGo supports over 70 crypto assets, making it a versatile platform for users interested in a broad range of cryptocurrencies. This includes major cryptocurrencies, DeFi tokens, and NFTs (Non-Fungible Tokens), providing a comprehensive crypto asset management solution.

4. User-Friendly Interface and Accessibility: ZenGo is known for its user-friendly interface, making it accessible and straightforward for both beginners and experienced users. The availability of dedicated apps for Android and iOS enhances its accessibility, allowing users to manage their crypto assets on the go.

5. Efficient Customer Support: Offering real customer support 24/7 is a significant advantage, especially in the often complex world of cryptocurrency trading and management. This ensures that users can get timely assistance whenever needed.

6. Attractive for New Users: ZenGo offers an incentive for new users with zero fees, making it an attractive option for beginners who are just starting with cryptocurrency trading.

Cons:

-

Limited Features in Certain Countries: ZenGo’s features and services may vary depending on the user’s location, which could limit its utility for users in certain countries.

-

Higher Fees: ZenGo’s fees range from 1.99% to 5.99%, which can be on the higher side compared to some other platforms. This might be a consideration for users who engage in frequent or high-volume transactions.

-

Limited Advanced Features: While ZenGo is excellent for basic buying, selling, storing, and trading activities, it may lack some of the advanced trading features that platforms like Coinbase offer.

In summary, ZenGo is a strong Coinbase alternative for users who prioritize security, ease of use, and control over their crypto assets. Its unique approach to security, wide range of supported assets, and user-friendly design make it an attractive option, especially for new users. However, its higher fees and potential limitations in advanced features or geographic availability may be drawbacks for some users.

2. Things to Consider When Choosing a Coinbase Alternative

If Coinbase doesn’t deliver the features you want in a Cryptocurrency platform, here are the features you should consider when using one.

2.1 Usage

Many Crypto wallets and platforms in particular offer different sets of features. That being said, you should know what to expect from a crypto app and consider the features accordingly. There are certain options you should consider like whether you will invest only for a short time, trade, or stake, or if you plan to invest for the long term.

2.2 Number of Digital Assets

Some platforms are more advanced compared to others. That being said, while pretty much all platforms support the most popular currencies, managing separate wallets for each currency that isn’t as popular gets overwhelming and difficult. Always choose a crypto wallet that supports at least 50 cryptocurrencies, if you manage more than one cryptocurrency.

2.3 Flexibility

Most crypto platforms are available on the web or as a desktop program. However, the best crypto wallets and platforms also offer dedicated mobile apps compatible with iOS and Android devices. In addition to that, a good crypto platform will provide a QR code scanner to access the mobile crypto wallet. That way, your wallet will be able to generate and scan a QR code in order to complete a transfer or some other transaction between users.

2.4 Clean Interface

Being clean and user-friendly are two things that every crypto platform should provide, especially if the user is new and needs some time to get used to the infrastructure of blockchain and crypto transfers. It should be quite easy to figure out how to use it. Most of the apps that we listed below have clean and beautiful interfaces that provide an impeccable user experience.

Many platforms also offer a detailed Learning Center which is equipped with detailed blog posts and video tutorials that make getting used to the app easier.

2.5 Availability in Different Countries

Due to different legal procedures and standards, cryptocurrency exchange platforms aren’t available in every country, especially because in some countries crypto is not a legal type of currency. Some platforms are not even available in all states of the USA, as well as some big countries.

Some coins aren’t recognized in different countries which means trading certain altcoins in different parts of the world will be impossible. One good example of that is that Binance isn’t available in certain states in the USA. Some Coinbase alternatives aren’t available in other big countries so it’s always good to visit the official website and read about the availability.

3. Frequently Asked Questions

When choosing the perfect crypto trading platform for tracking your investments and transactions, one may have a lot of questions that may need to be answered. Here’s a dedicated FAQ section that tries to answer all the questions related to the best Coinbase alternatives.

3.1 Is Coinbase Safe?

When working with crypto, one must be aware that you’re working with decentralized data. However, Coinbase is pretty much safe to use. Being careful on your side won’t hurt anybody, however.

3.2 Should I Choose Binance or Coinbase?

Both Coinbase and Binance have similar features. However, if you’re located in the USA, you will get to enjoy more features and offers from Coinbase compared to Binance. Moreover, Binance isn’t available in all the states.

International traders may not be able to benefit too much from using Coinbase, as opposed to Binance. It’s worth mentioning that Coinbase offers its own digital wallet which is compatible with Coinbase as well as other exchanges. Coinbase also offers you to withdraw to your PayPal account rather than straight to your bank account. Binance is better in regards to lower fees compared to Coinbase.

3.3 What is the Safest Platform to Buy Crypto?

As mentioned before, all the exchange platforms we listed above are safe, just as Coinbase is. If we didn’t consider these apps to be secure and to respect your privacy, we wouldn’t have listed them in the first place. However, if we had to pick the two most secure Coinbase alternatives, those would definitely be Gemini and ZenGo.

4. Conclusion

Although Coinbase is an ideal app to get started with trading and investing especially if you’re in the United State, it simply doesn’t work for everyone, and some policy approaches as well as fees may be more suitable for a certain group of users. In this list, we ensured to list all the apps that had similar fees or policies to Coinbase but still a more approachable model for both beginners and advanced institutional traders. What Coinbase alternative is your favorite? Which crypto trading platform do you use?

We earn commissions using affiliate links.

![Best Zoom Alternatives [year] Top Picks for Online Meetings Best Zoom Alternatives](https://www.privateproxyguide.com/wp-content/uploads/2022/01/Best-Zoom-Alternatives-150x150.jpg)

![Best SSL Certificate Providers [year]: Top Picks for Security Best SSL Certificate Providers 2021](https://www.privateproxyguide.com/wp-content/uploads/2019/05/Best-SSL-Certificate-Providers-150x150.jpg)

![Best Note-Taking Apps for Android in [year] – Top Picks Best Note-taking Apps for Android 2021 - Free & Paid](https://www.privateproxyguide.com/wp-content/uploads/2019/10/Best-Note-Taking-Apps-for-Android-150x150.jpg)

![Best Web Scraping Tools [year]: Top Picks for Data Extraction Best Web Scraping Tools](https://www.privateproxyguide.com/wp-content/uploads/2022/11/Best-Web-Scraping-Tools-150x150.jpg)

![Best Network Testing Tools [year]: Top Picks for Performance Best Network Testing Tools](https://www.privateproxyguide.com/wp-content/uploads/2023/01/Best-Network-Testing-Tools-150x150.jpg)

![Best AI Writing Detection Tools [year]: Top Picks for Accuracy Best AI Writing Detection Tools](https://www.privateproxyguide.com/wp-content/uploads/2023/02/Best-AI-Writing-Detection-Tools-150x150.jpg)

![Best Data Recovery Software for Windows [year] – Top Picks Best Data Recovery Software For Windows](https://www.privateproxyguide.com/wp-content/uploads/2023/04/Best-Data-Recovery-Software-For-Windows-150x150.jpg)

![Best Dropbox Alternatives [year]: Top Cloud Storage Solutions Best Dropbox Alternatives](https://www.privateproxyguide.com/wp-content/uploads/2021/11/Best-Dropbox-Alternatives-150x150.jpg)

![Best CCleaner Alternatives [year]: Top Tools for PC Optimization Best CCleaner Alternatives](https://www.privateproxyguide.com/wp-content/uploads/2022/10/Best-CCleaner-Alternatives-150x150.jpg)

![Best Free Word Processors [year]: Top Alternatives to Microsoft Word Best Free Word Processors](https://www.privateproxyguide.com/wp-content/uploads/2022/10/Best-Free-Word-Processors-150x150.jpg)

![Best Omegle Alternatives [year]: Top Sites Like Omegle Best Omegle Alternatives](https://www.privateproxyguide.com/wp-content/uploads/2024/03/Best-Omegle-Alternatives-150x150.jpg)

![10 Best VPN for Coinbase [year]: Fast & Secure Crypto Access Best VPN for Coinbase](https://www.privateproxyguide.com/wp-content/uploads/2022/11/Best-VPN-for-Coinbase-150x150.jpg)

![10 Best Residential Proxies: Top ISP Options for [year] Best Residential Proxy Providers 2024](https://www.privateproxyguide.com/wp-content/uploads/2021/03/best-rotating-residential-proxies-2021-150x150.jpg)

![Best Usenet Providers [year]: Top Services for Speed and Retention Best Usenet providers](https://www.privateproxyguide.com/wp-content/uploads/2019/09/best-usenet-providers-150x150.jpg)

![Best Spy Apps for iPhone & Android [year] Top Choices Best Spy Apps for iPhone and Android](https://www.privateproxyguide.com/wp-content/uploads/2021/11/Best-Spy-Apps-for-iPhone-and-Android-150x150.jpg)